In bookkeeping, Balance B/D and Balance C/D are terms used for balancing and closing of ledger accounts from the current period to the following period.

Balance B/D – is the balance brought down as opening balance of a ledger pulled from the previous accounting period.

Balance C/D – is the balance carried down as the closing balance of a ledger pushed to the next accounting period.

If Debit side > Credit side it is called Debit Balance

If Credit side > Debit side it is called Credit Balance

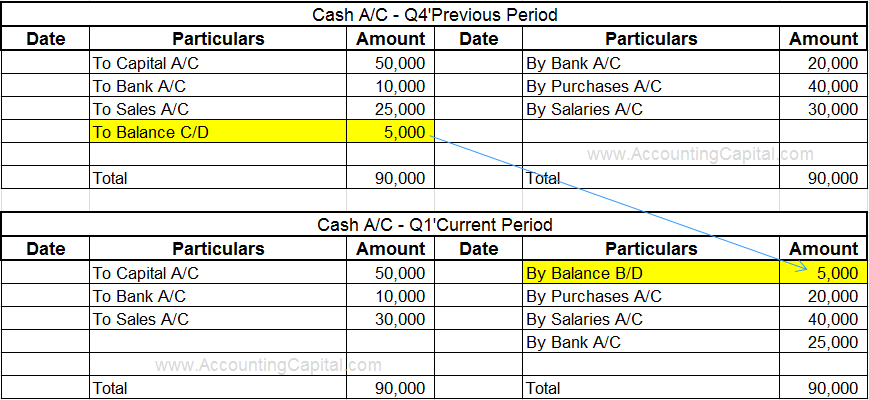

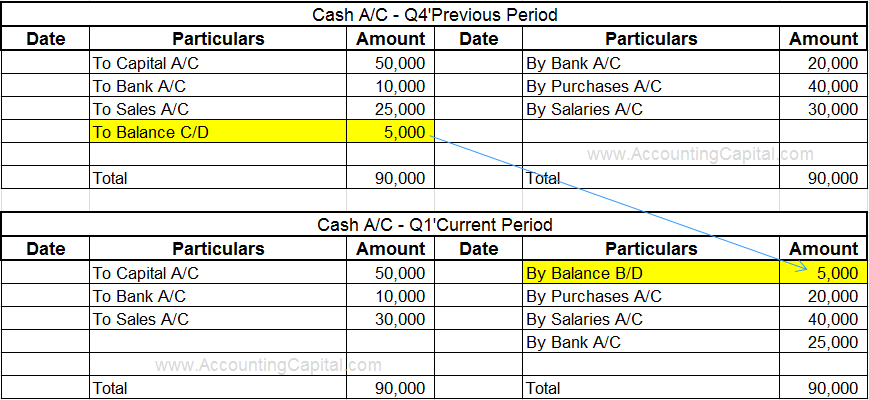

To Balance c/d – In a ledger account when Credit side > Debit side the difference in balance is inserted on the debit side to balance the account, the differential amount is denoted as “To Balance c/d”.

By Balance b/d – In the following accounting period closing credit balance of previous period (To Balance c/d) is brought down to the credit side of ledger account, this amount is the opening balance of next period and is denoted as “By Balance b/d”.

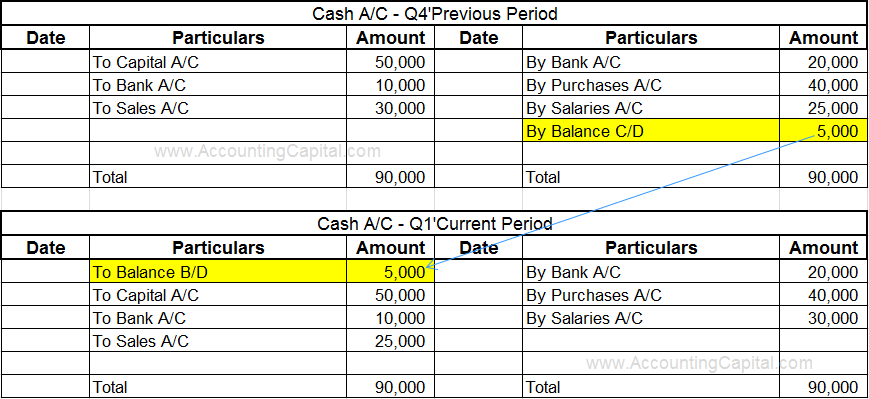

By Balance c/d – In a ledger account when Debit side > Credit side the difference in balance is inserted on the credit side to balance the account, the differential amount is denoted as “By Balance c/d”.

To Balance b/d – In the next accounting period closing debit balance of previous period (By Balance c/d) is brought down to the debit side of ledger account, this amount is the opening balance of next period and is denoted as “To Balance b/d”.

Asset, Liability & Capital accounts are balanced whereas Revenue and Expense accounts are not balanced.